how are discount rates determined ,Discount Rate Guide: Definitions, Formulas, Examples,how are discount rates determined, The discount rate refers specifically to the rate used to determine the present value of future cash flows or the rate charged by the Fed. In contrast, the interest rate is the percentage charged on borrowed funds in general. Omega Watches: Price: Omega Constellation 131.10.25.60.02.001 Watch For Women ₹ 2,89,700 Omega Constellation 131.10.28.60.02.001 Watch For Women ₹ 3,00,800 Omega .

When you're looking to value a company or make investment decisions, one of the most critical concepts you'll encounter is the discount rate. It's a fundamental tool in finance, especially when you’re assessing the value of future cash flows, which is common in Discounted Cash Flow (DCF) analysis. But, how exactly are discount rates determined, and what role do they play in investment valuation?

In this comprehensive guide, we will delve into what discount rates are, how they are determined, how they are used by the Federal Reserve and in corporate finance, and how to calculate them for a DCF analysis. This is a must-read if you're looking to understand how financial professionals assess the present value of future cash flows and how to apply it to your investment strategies.

What Is a Discount Rate?

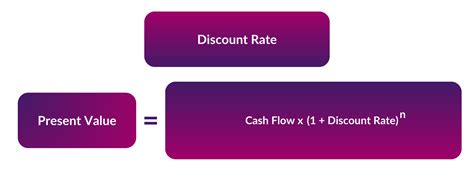

At its core, the discount rate is the rate of return used to discount future cash flows to the present value. In simpler terms, it’s the interest rate used to determine the current value of money that will be received in the future. This is crucial in finance because money today is more valuable than money tomorrow due to factors like inflation, risk, and opportunity cost.

Why is the Discount Rate Important?

Discount rates are pivotal because they reflect the time value of money (TVM)—the principle that money received today is worth more than the same amount received in the future. By applying a discount rate, financial analysts can assess whether future cash flows justify the initial investment in a project or a business.

Where Is the Discount Rate Used?

The discount rate is primarily used in Discounted Cash Flow (DCF) analysis, which is one of the most common methods of business valuation. It’s also widely used in capital budgeting, investment decisions, and to determine the value of bonds. The calculation of the rate can depend on several factors, including the risk of the investment, the required rate of return, and the overall cost of capital.

Discount Rate: How It’s Used by the Fed

When we talk about the Federal Reserve (the Fed), it plays a significant role in determining the discount rate in a macroeconomic context. The Fed’s discount rate refers to the interest rate it charges banks for borrowing money from the Federal Reserve's discount window.

This rate is important because it directly affects the money supply in the economy. When the Fed raises the discount rate, borrowing becomes more expensive for commercial banks, which often leads to higher interest rates for businesses and consumers. This can slow down economic growth and help control inflation. Conversely, when the Fed lowers the discount rate, borrowing becomes cheaper, stimulating economic activity.

In the context of DCF analysis, the discount rate used may be influenced by macroeconomic factors like the Fed’s policies, which can impact inflation expectations and the overall risk premium that investors demand.

Discount Rate: What It Is and How It Is Used

The discount rate is not a one-size-fits-all figure. It depends on several factors, including:

1. Risk of the Cash Flows: More uncertain or risky cash flows demand a higher discount rate. For example, a startup business will have a higher discount rate than an established company because of the uncertainty surrounding its future cash flows.

2. Cost of Capital: This includes both the cost of debt and the cost of equity, which we will explore later. The discount rate is often derived from the company’s weighted average cost of capital (WACC), which blends the cost of debt and equity financing.

3. Inflation: Inflation erodes the value of money over time. A discount rate typically includes an inflation premium to account for this factor.

4. Market Conditions: The prevailing economic conditions, such as interest rates set by central banks, risk-free rates, and overall market volatility, also play a significant role in determining the appropriate discount rate.

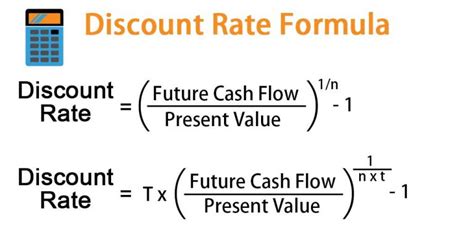

How to Calculate the Discount Rate in a DCF Analysis

A Discounted Cash Flow (DCF) analysis is a method used to determine the value of an investment based on its expected future cash flows. These cash flows are adjusted for the time value of money using the discount rate. The formula for calculating the DCF is as follows:

\text{DCF} = \sum_{t=1}^{n} \frac{C_t}{(1 + r)^t}

Where:

- \( C_t \) = Cash flow at time \( t \)

- \( r \) = Discount rate

- \( t \) = Time period

- \( n \) = Total number of periods (usually years)

To calculate the discount rate in the context of a DCF analysis, there are two main components:

how are discount rates determined ชมคอลเลคชั่นนาฬิกาสำหรับสุภาพบุรุษและสุภาพสตรีของ omega® ทั้งหมดและเพลิดเพลินไปกับความเป็นเลิศด้านการผลิตนาฬิกา ตั้งแต่ปี 1848 omega® ได้รังสรรค์ .

how are discount rates determined - Discount Rate Guide: Definitions, Formulas, Examples